Revolutionizing Satellite Operations and Market Viability: The Case for VLEO

How Very Low Earth Orbit (VLEO) Satellites Are Redefining Connectivity, Defense, and Market Opportunities

The unique characteristics of Very Low Earth Orbit (VLEO) satellites present distinct challenges in satellite and constellation design, creating a substantially different market case for VLEO operations. This article serves as a foundational exploration of VLEO technology, outlining its benefits, challenges, and economic potential. Our forthcoming in-depth analysis will dive deeper into the technical, market, and financial viability of VLEO constellations.

Introduction

In an age where global connectivity and data are paramount to success across the defense and commercial domains, we have seen the rapid entry of companies bridging digital divides with satellites. What started as early communications technology with limited but vital capabilities in GEO orbit, space connectivity and satellite constellations have exploded to become a critical lynchpin enabling the global economy. Today, Low Earth Orbit (LEO), ranging from 400km up to 2,000km, has become the dominant orbit for providing connectivity. As of February 2025, 7,480 of the over 10,000 earth orbiting satellites operate in LEO, according to the satellite-tracking website Orbiting Now. The rapid expansion of LEO constellations has transformed industries, supporting applications from climate monitoring to providing critical communications in the Russia-Ukraine war.

For many satellite operators, VLEO represents the next frontier, offering unprecedented opportunities for enhanced performance and innovation. Positioned below 400 km, VLEO satellites provide superior communication bandwidth, reduced latency, and significantly improved Earth Observation (EO) capabilities. While scientific payloads such as the European Space Agency’s Earth Explorer GOCE (2009-2013) and Japan’s Super Low Altitude Test Satellite (2017-2019) have demonstrated the technological feasibility of this orbital domain, they have also highlighted the complexities of operating at the atmosphere’s edge. The descent from LEO to VLEO means a dramatic increase in atmospheric drag, necessitating near constant propulsion. Systems must also be designed to account for the degradation of critical components caused by atomic oxygen.

VLEO: Proposed Benefits

The benefits of bringing satellite constellations closer to Earth are numerous and span across multiple domains of satellite operations. The transition from Geostationary orbit (GEO) to Low Earth Orbit (LEO) has already revolutionized satellite networking, reducing latency from over 500 milliseconds to values comparable to fiber-optic networks, typically in the range of tens of milliseconds. VLEO presents an opportunity to push these benefits even further.

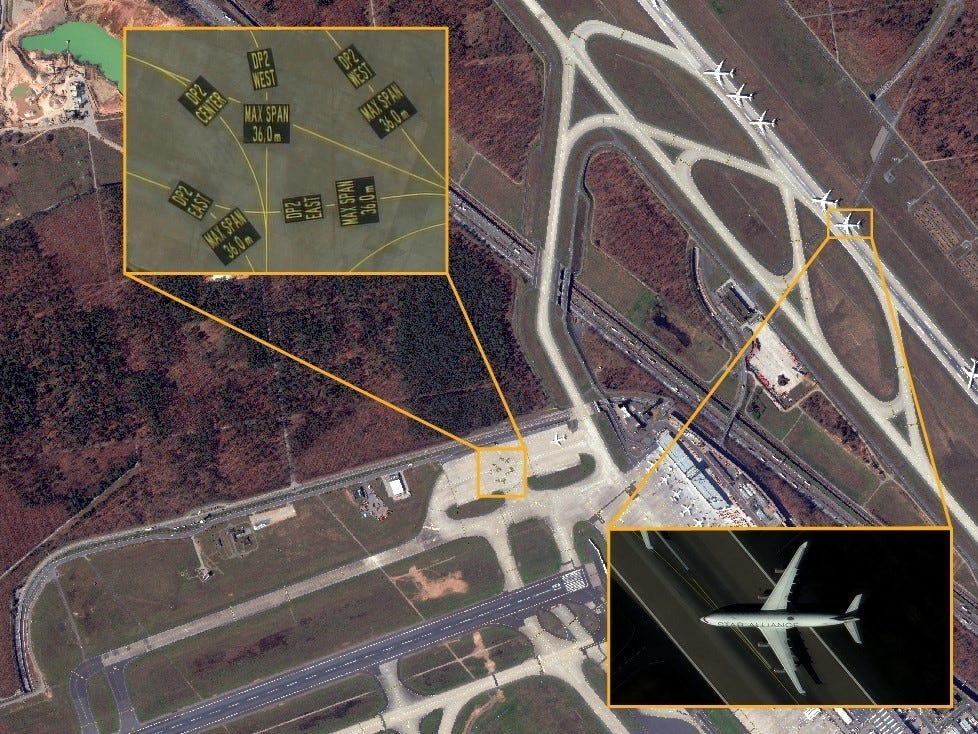

For Earth Observation (EO), VLEO offers significant the benefits. By positioning satellites closer to the Earth's surface, the resolution and clarity of captured images are significantly improved, allowing for finer detail and more accurate data collection in applications like environmental monitoring, urban planning, and disaster response. Our analysis has found that enabling 15cm resolution with a sub-one-meter sensor serves as a “holy grail” for earth observation. For reference, the Hubble Space Telescope’s main mirror is 2.4 meters in diameter and weighs almost 1 ton. Large sensors like this are impractical for VLEO and large-scale constellations.

While the Earth Observation (EO) benefits of VLEO are well-documented, the advantages for RF communications, though significant, require further analysis. VLEO satellites leverage the inverse square law to reduce latency and enhance data throughput, making them valuable for broadband internet, IoT connectivity, and secure communications.

A high-level link analysis reveals key advantages of VLEO, including lower free-space path loss and stronger received signals at ground stations. This improves link margins, supports higher data rates, and reduces power demands for both satellites and user terminals. However, while halving orbital altitude increases received power by a factor of four, it equates to only a 6 dB gain due to the logarithmic nature of signal strength. Though modest, these gains could significantly transform satellite communications, enabling direct-to-cell and small-device connectivity with smaller transmitters.

For the national security and defense market, VLEO offers significant enhancements in satellite survivability through “maneuvering” and reduced radar visibility associated with lower altitude. For example, reducing orbital altitude from 600 km to 300 km shortens the detection and interception timeframe for adversaries by approximately 25%, giving less than five minutes to track and engage the satellite, a difficult task for even the best air and missile defense systems. In addition, VLEO is a self-cleansing orbit, allowing debris from disabled or destroyed satellite to naturally deorbit and burn up in the atmosphere. This reduces the risk of long-term orbital congestion and making it harder for adversaries to create lasting disruptions through anti-satellite attacks.

Beyond survivability, VLEO also provides key advantages for the Department of Defense (DOD) by diversifying orbital regimes, reducing reliance on higher, more predictable satellite constellations that may be vulnerable to tracking and targeting. The ability to deploy and replenish assets in VLEO enhances resilience and operational flexibility, making it easier to rapidly replace lost capabilities. Additionally, the maneuverability enabled by VLEO station-keeping introduces an added layer of unpredictability, complicating enemy targeting efforts. These factors position VLEO as an attractive option for future defense and intelligence applications, offering dynamic and resilient satellite architecture suited to contested space environments.

Designing a VLEO Optimized Satellite

While the benefits of VLEO are clear, there are several operational challenges that satellite design must account for to manage the atmospheric constraints of VLEO. The key aspects and design decisions involves optimizing engine type, orbital altitude, and minimizing satellite frontal area. NASA’s upper atmospheric density models show density decreasing exponentially with altitude. Using the mean solar activity model, raising a satellite’s orbit from 100 km to 120 km reduces atmospheric density by nearly 2,000%, while at the same 20 km increase from 380 km to 400 km results in only a 25% reduction. This underscores the significant impact of altitude on drag, which must be factored into satellite bus and orbital design.

Modeling seven thrust modes reveals several key aspects of VLEO satellite design. For example, cryogenic rocket engines are not feasible for long duration station keeping due to fuel boil off. Low performance chemical engines such as those powered by hydrazine or hypergolic fuels avoid issues with fuel lifespan, attractive features for long duration VLEO missions, but suffer from extremely low efficiency. Chemical engine’s main benefits, primarily proven engine design, are outweighed, by the need to carry almost six times as much fuel as even the lowest efficiency ion engine.

Finally, optimizing satellite structure is essential to extending mission lifespans and maintaining operational efficiency. Minimizing the frontal area and employing other drag reduction strategies significantly enhance durability in VLEO.

VLEO Constellations and Launch Costs

Because satellite launches prioritize LEO, VLEO satellites deploy by gradually descending from LEO. However, launching directly into VLEO could yield substantial performance improvements. Analysis of launch vehicles such as Rocket Lab’s Electron and Northrop Grumman’s offerings indicates a 20-30% increase in payload capacity when targeting VLEO instead of higher altitudes.

SpaceX’s rideshare offering currently deploys satellites to LEO, requiring VLEO satellites to lower their orbits using onboard propulsion. This creates a barrier for new entrants needing dedicated launches, adding cost and complexity. However, the high flexibility and precision of modern launch systems such as SpaceX’s Falcon 9 and Starship, along with Blue Origin’s upcoming New Glenn could upend this model, making direct-to-VLEO launches more viable and reshaping access to this emerging market.

The VLEO Market Case

Despite high upfront capital expenditures, VLEO provides a favorable market case. LEO constellations, including Starlink, are currently deploying direct-to-cell communication using a new generation satellite architecture. VLEO, through lower orbital altitudes, greatly reduces the radio requirements for these operations, a key benefit when transmitting to smaller phone antenna systems. VLEO also provides latency benefits for all means of communication, compared to GEO or MEO, and moderate gains when compared to LEO. VLEO’s greatest benefits and market adoption potential lie in its ability to seamlessly interface with small devices, including cell phones, IoT devices for commercial applications, and individual radios and location systems for DoD operations. These factors led SpaceX to pursue 340-360 km orbits for its Gen-2 Starlink constellation, but the FCC denied the request due to potential conflicts with the ISS.

With comparable performance in small-device communication, the business model of a VLEO constellation would be very similar to those found across terrestrial providers. Business case closes at $75/month, similar to pricing for the high-end cellular plans offered by Verizon, T-Mobile, and AT&T. When compared to satellite home internet providers, it remains 30-40% cheaper than Starlink’s offering of $120/ terminal/month, not including purchasing the terminal. It remains to be seen whether Starlink’s cost will decrease for individual users and if they are able to compete with traditional cell providers.

Beyond competitive pricing for communications, VLEO also provides a coverage advantage. According to Ericson Mobility Reports, mid-band 5G coverage of North America reaches 85% of the population. Even when accounting for lower speed 5G, which is significantly lower in both bandwidth and capabilities, that figure holds at 90%. The relatively high population of North Americans without 5G access, with a concentration in the United States, provides a particularly favorable market with over 30 million Americans without access to 5G. This figure is well aligned with the FCC’s effort to spend $9 Billion to “expand” 5G access to approximately 10 million Americans in rural areas. A well-designed VLEO constellation could bridge this gap while maintaining competitive pricing.

The primary revenue driver for VLEO constellations is the recurring income generated from communication services. Based on our operating model’s base-case scenarios across key variables, optimal revenue performance is achieved when the constellation is positioned at altitudes between 300 km and 320 km.

At an operational altitude of 300-320 km, achieving Minimum Viable Coverage (MVC) of the Earth would require approximately 450-500 satellites. Assuming each satellite provides around 20 Gbps of bandwidth, the network could support 450,000 to 500,000 high-speed internet users. At a subscription rate between $75 and $100 per month, comparable to what many users already pay for phone or internet service, annual revenue could range from $400 million to $600 million. However, these gains must be weighed against the constellation’s significant upfront costs and ongoing operational expenses. Deployment is estimated at around $1.2 billion, with a five-year depreciation model bringing annual costs to approximately $250 million. This would leave an estimated operating profit between $150 million and $350 million per year, depending on user adoption and pricing strategy.[RS2]

This analysis of VLEO constellations highlights the operational and financial advantages that make this orbital domain increasingly viable. By optimizing satellite positioning, propulsion strategies, and network design, VLEO systems can deliver substantial improvements in communication performance, imaging capabilities, and overall cost efficiency. Financial modeling demonstrates that while initial capital expenditures are significant, the recurring revenue potential and strategic advantages position VLEO as a compelling market opportunity, particularly when addressing unmet communication needs.

The insights presented here serve as a foundation for understanding how these systems can be developed and sustained effectively. Stay tuned for our next article, where we will take a deep dive into the technical aspects of VLEO operations, quantifying performance improvements, exploring propulsion solutions, and conducting an in-depth financial modeling exercise for a hypothetical VLEO company.

This article was developed with research and drafting support from R.J. Sylak.

Yes!